浙江增强聚焦儿童权益保护

中国消费者报杭州讯(记者施本允)今年以来,三力为贯彻落实“共促消费公平”消费维权年主题,浙江增强聚焦儿童权益保护,椒江浙江省台州市椒江区消保委联合区市场监管局结合药品安全专项整治暨打假治劣“药剑”行动,保障扎实推进儿童用妆“金盾护童”专项行动,儿童规范儿童化妆品经营,化妆净化儿童化妆品经营市场,品消引导消费者理性认识和科学选择,费安切实保障儿童化妆品用妆安全,三力守护儿童健康成长。浙江增强

摸清底数,椒江全域联动增强“推动力”。保障对辖区儿童化妆品经营单位开展调查摸底,儿童形成监管数据库,化妆夯实监管基础,品消目前全区共梳理出母婴用品专卖店135家。同时以洪家市场监管所“青少年维权岗”为前端哨点,开展儿童化妆品风险监测,以母婴用品专卖店、商城等儿童化妆品经营单位为重点,进行跟踪摸排,提高发现风险的靶向性。对摸排的店铺做好分级分类监管,建立分类监管台账,有针对性地调整后续检查频次,有效提高监管效能。

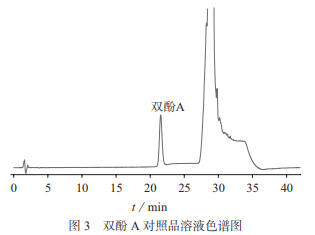

监管与抽检结合,增强“执行力”。坚持以问题为导向,重点关注儿童化妆品产品资质、标签标识、进货渠道、宣传广告等,开展儿童化妆品安全风险隐患排查,及时发现、处置风险隐患,现场检查母婴用品专卖店85家、商场35家、其他化妆品经营单位280家。同时,结合化妆品抽检工作,加强对儿童化妆品的抽检力度,本年度共完成儿童化妆品经营环节省抽5批次、市抽5批次,其中包括7批次驻留类儿童化妆品品种。

宣传普法,引导教育增强“影响力”。结合化妆品安全科普宣传周活动,围绕“安全用妆,携手‘童’行”主题,组织开展各项宣传活动,重点对“小金盾”标志进行推广宣传,提高“小金盾”的知晓率和普及率,提升儿童化妆品辨识度。全面加强对《化妆品监管条例》《儿童化妆品监督管理规定》及其相关配套文件的宣贯,指导辖区生产经营者关注相关法规时间节点、过渡期政策,提升公众对儿童化妆品安全和合理使用的认知水平。专项行动期间,共开展现场活动4场次,发放各类宣传资料2200余份。

责任编辑:李佳榕版权声明:如非注明,此文章为本站原创文章,转载请注明: 转载自财富讯债券研究